You're Witnessing a Global Debt Crisis

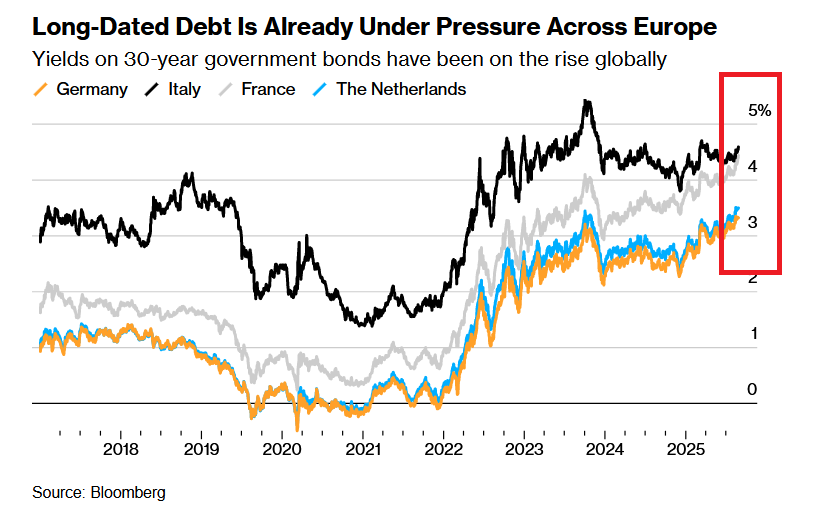

The global bond market is throwing a temper tantrum as long-term government bond yields are rising everywhere from the UK to Japan to France and of course… the US. While the United States currently runs the largest primary fiscal deficit among the world’s developed countries, the UK and France proudly take silver and bronze.

Some breaking headlines from this morning…

*GERMANY 30-YR BOND YIELD RISES TO 3.377%, HIGHEST SINCE 2011

*FRENCH 30-YEAR YIELD RISES ABOVE 4.5% FOR FIRST TIME SINCE 2011

France faces a potential collapse of it’s government as soon as September 8th when a no-confidence vote may remove the current leadership and it’s plan to cut spending. Yields on French 30-yr bonds are now at the highest since the euro-debt crisis.

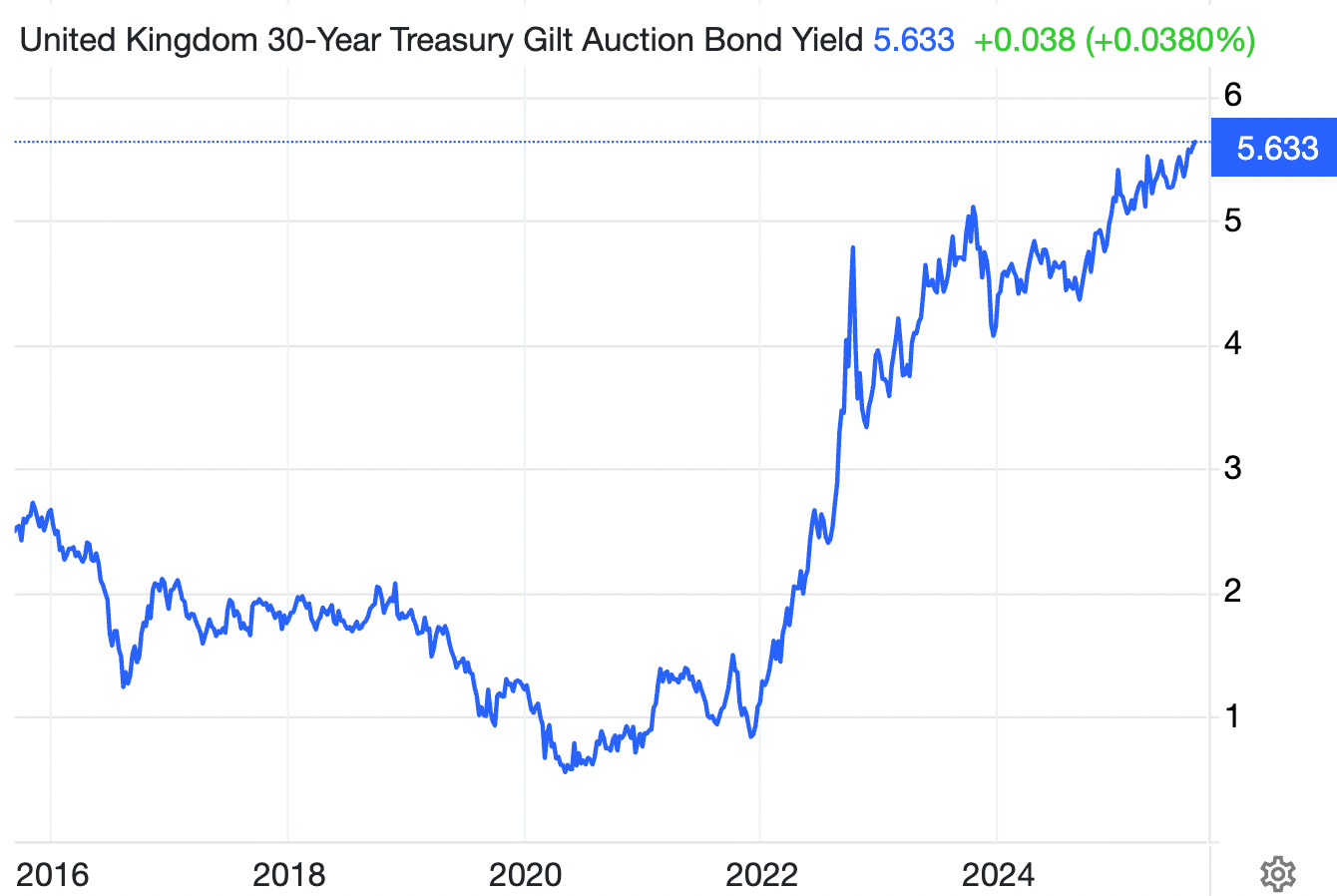

*UK 30-YEAR YIELD CLIMBS TO 5.66%, HIGHEST SINCE 1998

The UK is trapped in a horrific doom loop of rising borrowing costs and growing deficits. Yields on 30-yr gilts just hit their highest level in over 27 years. It’s possible we are about to see a “Starmer Moment”, possibly even worse than the catastrophe Liz Truss faced a few years back.

Why This Is Happening:

What makes these yield moves incredibly alarming is the fact that we are actually in the midst of a global rate cutting cycle. Normally, when central banks pause or cut rates, yields fall. However recently the opposite has happened. Central banks are cutting rates, with even the US Fed about to join them in 2 weeks, and yet yields are surging to multi-year and multi-decade highs. Simply put, we are getting HIGHER interest rates despite the central banks cutting rates. They have lost control. This is happening for a few reasons.

Soaring Deficits + Debt

Elevated/Rising Inflation

Central Bank Credibility Crisis

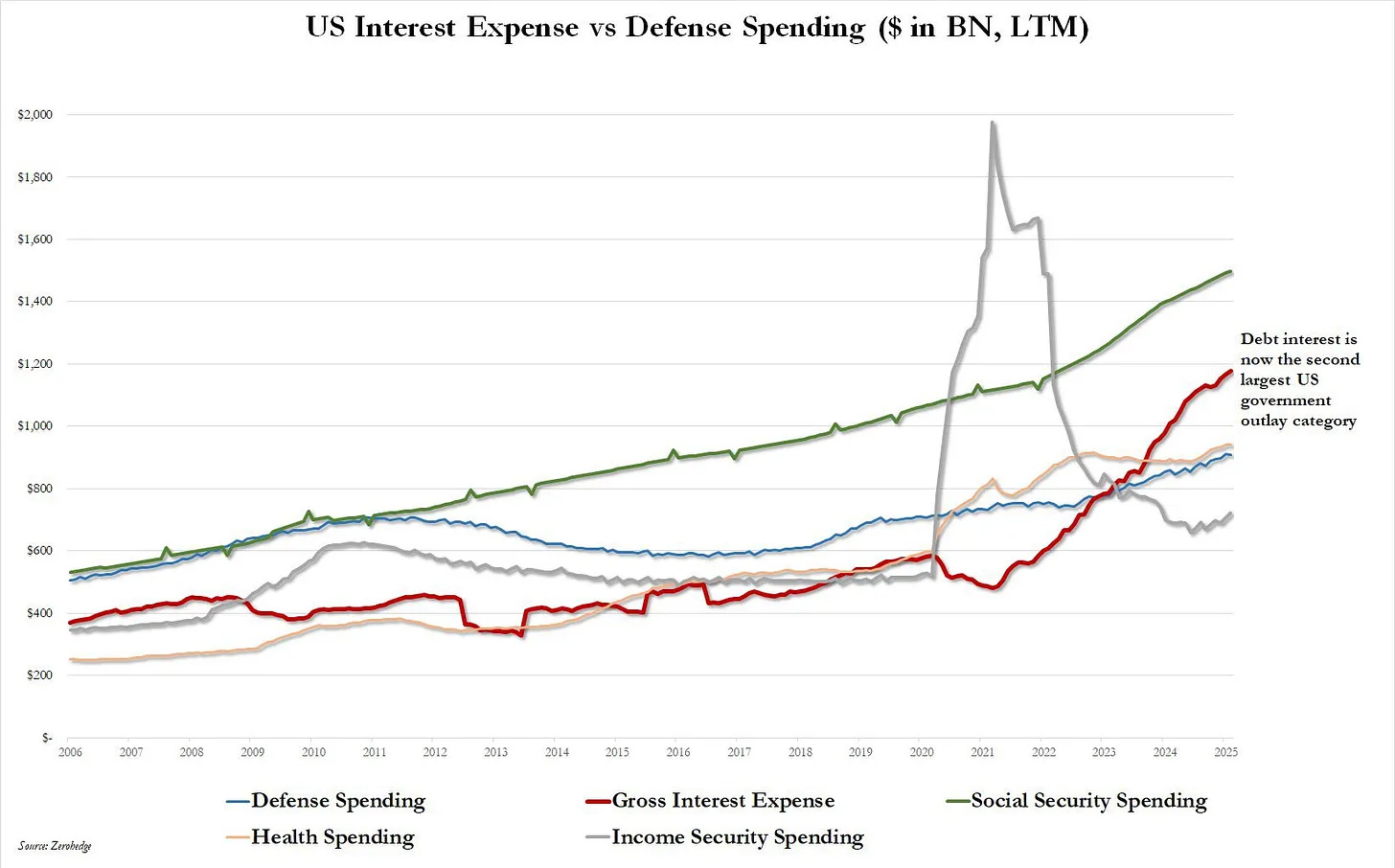

Looking at reason #1, much of the developed world is sitting in the same spot. These governments have ballooning annual deficits with an already out of control debt load. Because of the higher deficits and higher yields, these governments now face astronomical interest expenses on their debt.

Higher deficits = Higher yields.

Higher yields = Higher interest payments.

Higher interest payments = Higher deficits.

Repeat from step 1. Welcome to the “doom loop”.

For example, the interest expense on the US national debt has now exceeded both Medicare and the entire Defense budget. It will soon catch up and pass Social Security to become the single largest outlay in the entire United States budget. We will need to run higher deficits for the foreseeable future to pay this interest expense without defaulting. By running higher deficits, we will owe even more interest, which will increase our deficits further, racking up more interest to be paid, and so on…

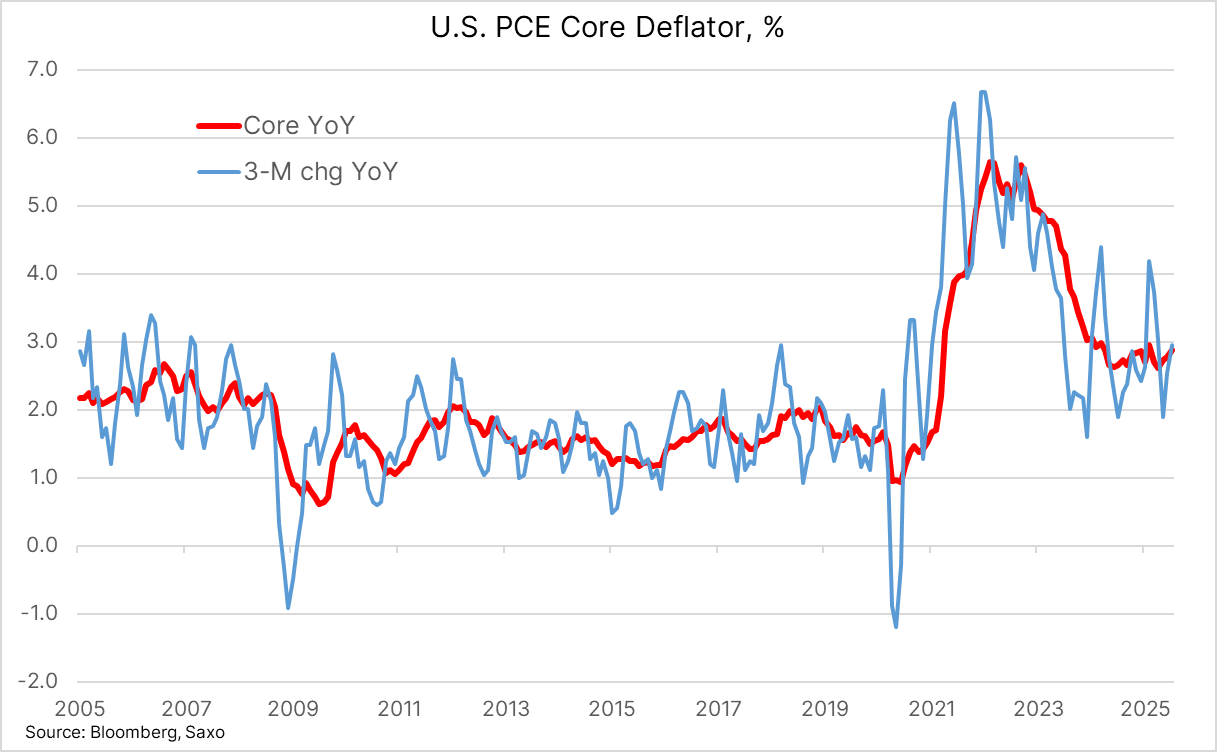

Looking at reason #2, inflation hasn’t been “defeated” no matter how many times Trump says it. CPI is still sitting at just under 3% YoY, almost 50% above the official target. Plus, Core PCE (the Fed’s favorite inflation indicator) has now risen for 4 months in a row and looks like it may have actually bottomed. Despite this, the Federal Reserve is about to join the global rate cutting cycle. This suggests a possible reacceleration of inflation, and yields are very clearly picking up on it.

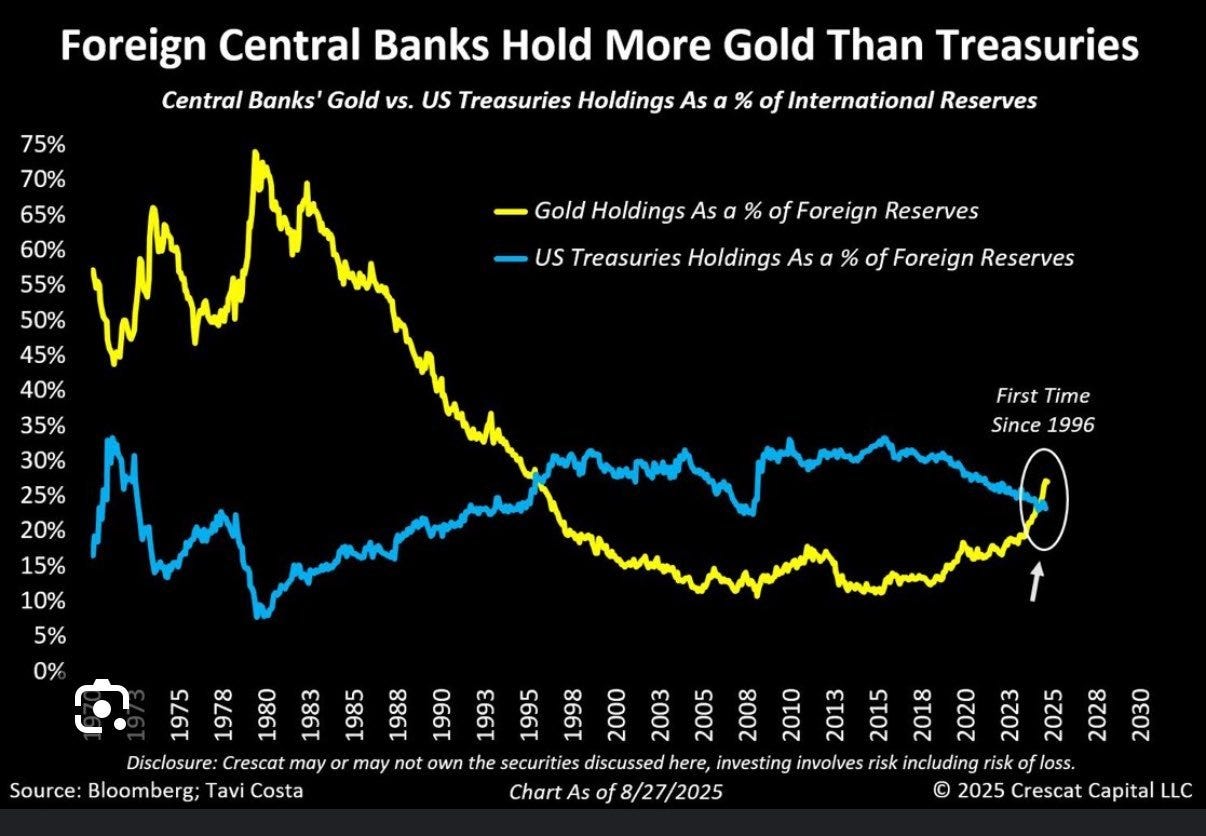

This brings us directly into reason #3, which is a lack of credibility for Central Banks. Inflation is at best sticky or even on the rise, and yet they are cutting rates. Even if it doesn’t reaccelerate, inflation is certainly still above their 2% stated target. Global investors are realizing that the developed countries are going to “run it hot”, cutting rates in a desperate attempt to stimulate growth and inflate away their debt, rather than cutting spending. This leads investors to demand a higher yield to hold their underwater bonds.

On the other side of the credibility crisis, we have outright political influence. Trump is blatantly trying to reshape the Federal Reserve board and you will see other governments attempt to do the same. When government’s get into a tough enough fiscal position, their central banks will be forced to assist them instead of prioritizing monetary policy. This is called Fiscal Dominance, and we are now there.

Conclusion:

The honest answer is that the US, European and many of the developed governments are simply too big. No politician wants to cut spending in any meaningful way, even though they do not have the tax revenue or growth to support it. They are being fueled and maintained by deficit spending, which is now unsustainable at higher global rates. This is becoming increasingly obvious and troublesome as the central banks are unable to bring down rates due to inflation. Their traditional brakes on the train no longer work in this environment. They still have some short-term tools available that they will deploy, but they are essentially like putting a band-aid on a gun shot wound. This is going to spiral until the bond market eventually forces the government to cut spending, but we can spiral for much longer than you think.

If you thought Gold and Bitcoin were doing well with the US running insane fiscal deficits, wait until the entire world goes fiscal at once and inflation picks back up.

*SPOT GOLD SURGES TO RECORD HIGH ABOVE $3,500

P.S. - There is a solid chance that Trump’s entire tariff regime is ruled illegal by the Supreme Court in the coming months. If so, while it may help consumers and the growth side a bit, it would also remove hundreds of billions in annual tax revenue that was being factored into the government’s budget. Lawsuits would be filed, refunds would be issued and the future loss of customs revenue would widen the US deficit even further once again. Yields are just beginning to price that part in as Trump’s OBBB will be even worse fiscally than initially projected.