Welcome to Uptober

Long-time followers know that I was not originally a “crypto guy”. My focus has been on traditional markets, economics and politics. However, over the last decade crypto (and specifically Bitcoin) has become a legitimate and established financial asset class, even on Wall Street. As we move into October, I have a few thoughts on Bitcoin currently and where it will go moving forward. Let’s dive in…

First, let me say that I have owned Bitcoin for years and still like it here. As I mentioned, I’m not a full-fledged crypto guy but in my view Bitcoin holds a similar investment thesis as gold. It could easily make up a few percent of any investor’s portfolio and provide diversification and protection against fiat currency debasement. That is now also much easier to accomplish with the incredibly popular Bitcoin ETF’s that launched in 2024. I think allocating to Bitcoin will only become more popular and common as younger investors who were always familiar with Bitcoin and the internet begin to replace the older, more skeptical investors who still remain in the market.

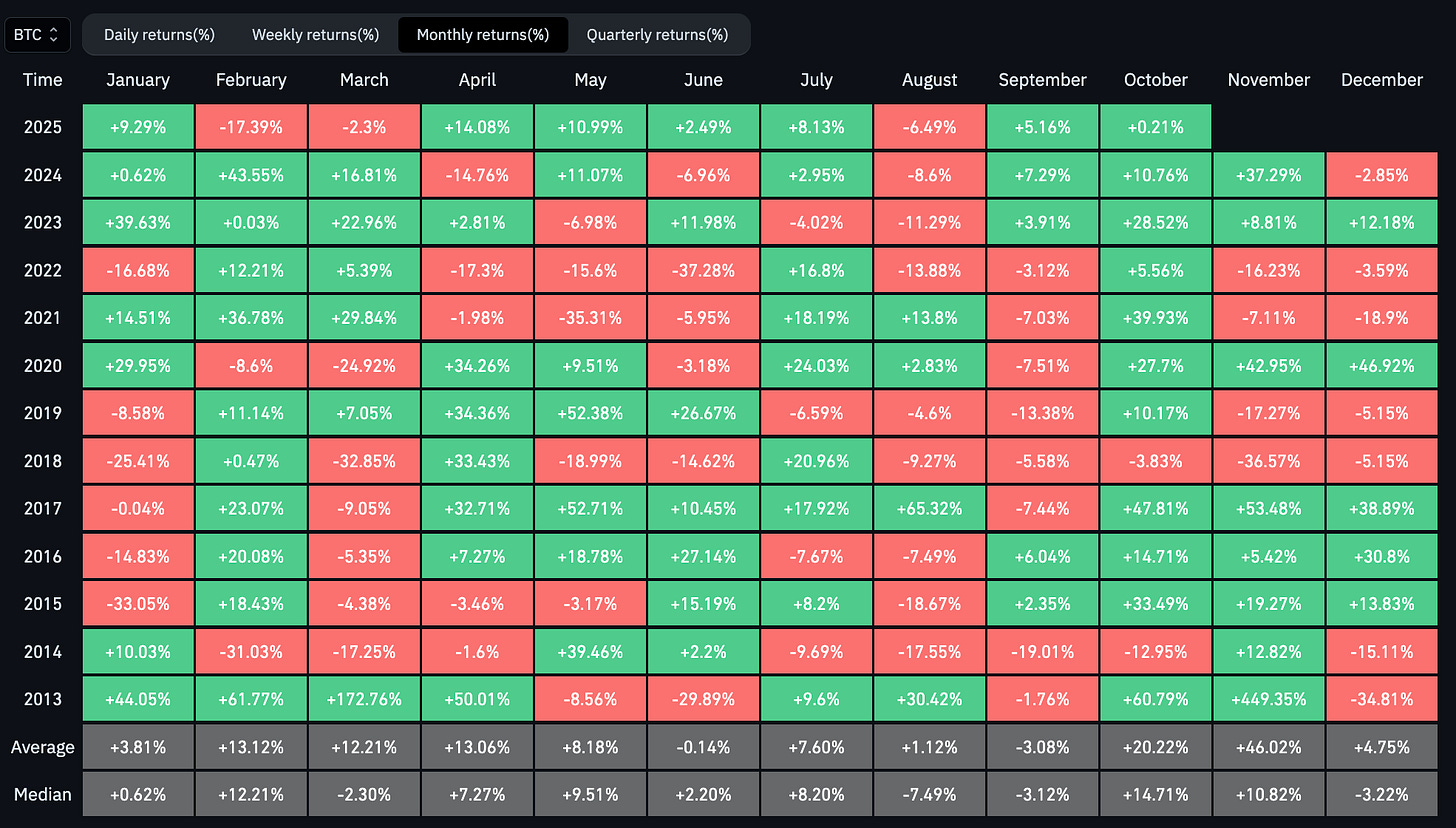

For those who may not know, crypto guys often refer to the month of October as “Uptober”. This is because of Bitcoin’s incredible seasonality and performance around the end of the year. Q4, and specifically October, is historically a very strong period for Bitcoin. Looking at the last decade plus, October is by far Bitcoin’s best and most consistent month. It has been positive in 10 of the last 12 Octobers, with an average gain of +20.22%. .

2024 was of course a Bitcoin halving/US election year. Bitcoin’s October performance during the previous three post-halving/post-election years was even better:

2021: +39.93%

2017: +47.81%

2013: +60.79%

I think it’s likely we see another big Uptober. If we pull up the Bitcoin chart it looks short-term bullish from a technical analysis perspective, with a massive rising wedge jumping off the screen. While this 2025 rising wedge could be bearish into 2026, it looks like Bitcoin should soon bounce back up towards ~130,000 and new highs in Q4.

Interestingly, when you look at Bitcoin in Gold terms (which continues to explode to new all-time highs day after day), it also looks like it is due for a rally in Q4. With Gold’s incredible performance recently, it appears it may be Bitcoin’s turn to play catch-up.

Of course, I need to briefly mention Bitcoin’s politcal angle. As we know, the Trump administration has now fully committed to Run the Economy Hot for the immediate future and we have entered an era of Fiscal Dominance. Hard assets will continue to thrive in the coming years as the dollar and global fiat currencies are printed and debased. Inflation is still running above the Fed’s target and yet we are now moving into a rate cutting cycle along with the rest of the world. As more and more people become aware of the persistent inflation and currency debasement, the significance of holding hard assets like houses, stocks, gold and Bitcoin will only grow.

This leads into why I remain bullish on Bitcoin’s longer-term outlook as well, even if it experiences a pullback or bear market in 2026. I think regardless of the macro environment outcome that we get this economic cycle, Bitcoin will continue to climb long-term. If the administration continues to run the economy hot, we will almost certainly experience an above-trend inflationary environment for the next several years. On top of the inflation, we also have growing concerns about the Fed becoming too political as they cut rates. Plus, global trust in US Treasuries as a neutral reserve asset has been shaken and central banks are now stacking gold. In this environment stocks, commodities, real assets and Bitcoin will all benefit greatly.

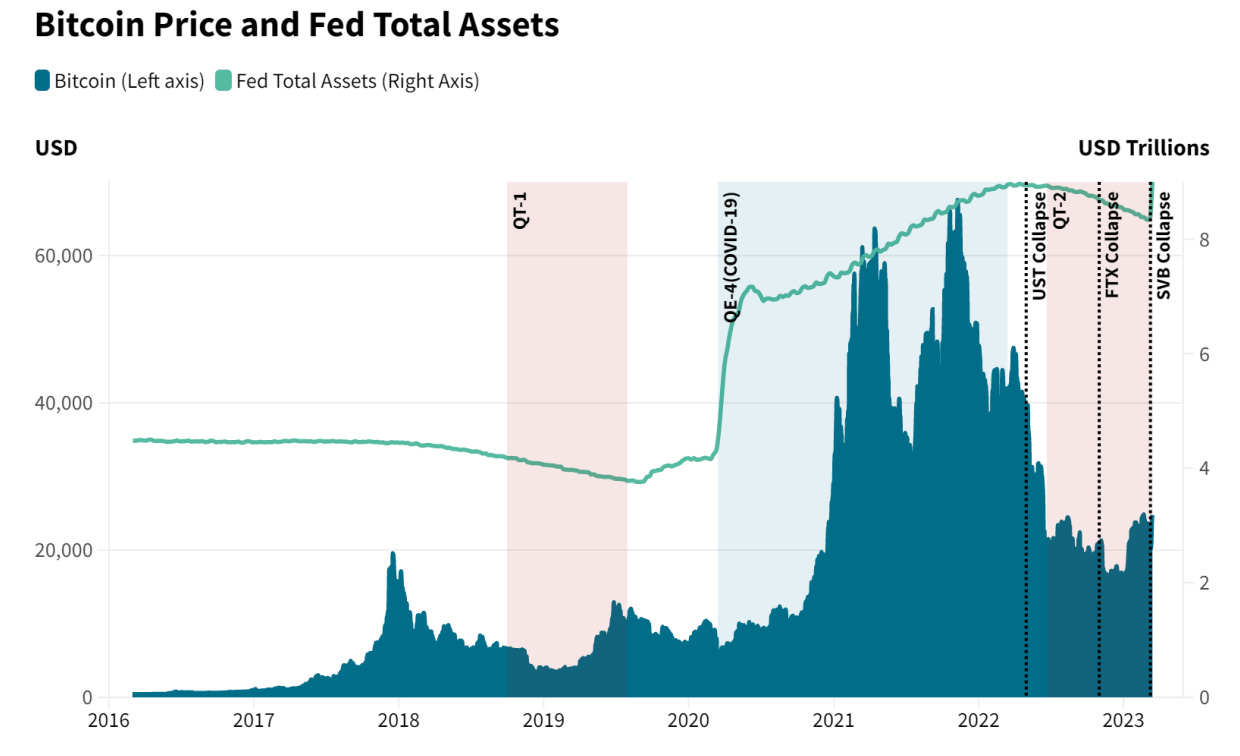

On the other hand, if growth slows and we get a recessionary environment with unemployment climbing dramatically, the Fed will actually have to cut rates even faster. While that may at first lead to a period of declining prices or even a bear market, it will quickly be followed by new stimulus measures as the Fed and Treasury are forced to ensure a strong recovery. This would officially bring about QE5 which will certainly be much bigger than QE4, as all QE rounds must be larger than the previous ones to be effective. The end result would be massive government spending, loosening financial conditions, ballooning deficits, along with sky-rocketing markets and asset prices. Bitcoin will take full advantage of QE5 just as it did with QE4, when it rose from ~$5,000 in March 2020 to ~$60,000 just one year later. A reminder that as of today we haven’t even stopped QT yet.

Either way this economic cycle plays out, I think Bitcoin is set up nicely in both the short-term (Uptober/Q4) and long-term (years ahead). I am bullish on Bitcoin seasonally, technically, politically and fundamentally. Happy Uptober.

As always, this is not financial advice. I am sharing my personal views. It is meant to stimulate ideas and is not to be considered investment advice. Please make your own decisions.

Just buy spot bitcoin on Robinhood or Coinbase

Good read & timely. Im new to bitcoin investing, can anyone advise best way to get exposure? ETF?