Unrealized Capital Gains Tax Is Coming

There is a growing movement in several Western governments to begin taxing unrealized capital gains. In fact, one major nation is about to implement this tax for the first time. What is an unrealized gains tax and why would it be an absolute disaster? Let’s dive in…

Unrealized Capital Gains Tax:

An unrealized capital gains tax is a proposed tax that would be levied on the increase in value of an asset before it is ever sold. This means that individuals would be taxed and penalized for owning appreciating assets, regardless of whether they have realized any actual income or profit from selling them.

To be blunt, this has always been and still is an ignorant and dangerous idea. Governments would essentially be punishing their citizens and investors for daring to hold assets long-term, while also massively destabilizing markets. Put simply, it’s an attack on individual wealth. This absurd tax could be applied to property, stocks, businesses and any other assets that appreciate in price or result in “paper profits”. It’s not just a bad idea, it’s an economic fallacy and a legitimate threat to capitalism.

Why It’s Horrible:

Taxing unrealized capital gains contradicts the basic principles of fairness, capitalism and property rights that are essential in a free and prosperous society. If we are going to tax people on their income, it should be based purely on their actual income earned, not paper gains that they haven’t even collected yet or may never actually materialize.

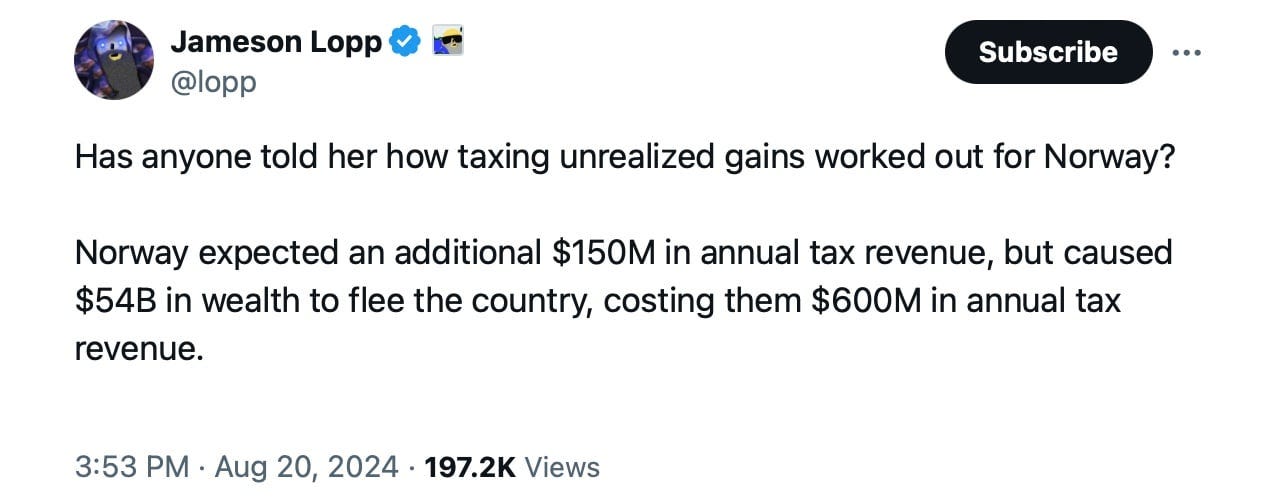

Taxing unrealized gains would also weaken economic activity by discouraging investment. If people know that the unrealized gains in their accounts or outside investments will be taxed, they will have less incentive to invest their money. Less stock, real estate and business investments will be a direct result. This will lead to a massive misallocation of resources, capital flight, destabilization of markets and much slower economic growth. The entire Venture Capital and start-up ecosystem would be severely damaged. Entrepreneurs, start-ups and small businesses rely heavily on outside investments from individuals willing to take risks in the hope of making a future return. Taxing their unrealized capital gains in those businesses will discourage further risk-taking and hinder innovation.

In terms of personal liberties and individual rights, an unrealized gains tax would be a complete breach of understanding between American/Western citizens and their governments. This would allow the government to infringe on individual property rights and financial privacy beyond anything previously imagined. The government would have unprecedented control over a person’s assets and personal wealth, sticking a hand in their pockets before the individual even gets to realize profit for themselves.

In economic practice, this would be as close to robbery as a tax could get. If you purchased a stock for $100 and it increased to $150, you would have to pay a tax on the $50 unrealized capital gain. You didn’t sell the stock so you don’t actually have a $50 profit, but still must pay a percentage to the government out of your pocket. Now, what if the following year the stock drops back to $100 resulting in a loss of appreciation? You now have $0 in paper profits. You’ve made nothing, yet you’ve paid the government a tax. Will the government be giving you a refund on your unrealized losses? I wouldn’t hold your breath. This is theft.

Slippery Slope:

You will often hear supporters of this insane tax say things like, “it’s only for the ultra-rich” or “it only applies to large stock holdings”. However, anyone with an IQ above 80 and a basic understanding of history knows this defense is moronic. A tax on unrealized gains, of any kind, starts us down a horrific path. If the government can tax unrealized gains for the Top 1% of earners today, what’s to stop them from expanding it to the top 10% or 25% a few years down the line? If they can tax unrealized gains on stocks now, what’s to stop them from including middle-class home value appreciation in the future. Taxing unrealized gains sets a dangerous precedent that can not be accepted in any shape or form.

Australia Goes First:

The Government of Australia has proposed a tax on unrealized gains set to impact individuals with large Superannuation balances. In Australia, Superannuations or “Supers” are similar to a Roth 401k in the US. They are employer-sponsored retirement accounts where income is taxed on the way in, and withdrawals are tax free during retirement. This new proposal, the Division 296 Super Tax, would introduce an additional 15% tax on earnings inside the Super account for individuals whose total superannuation balance exceeds $3 Million AUD. Under this proposal, unrealized gains (increases in asset values inside the account) will be taxed at 15% each year. Investors and citizens will be required to pay this tax even if they haven’t sold any of the appreciated assets.

The Australian Government wants this tax to start applying this year, from July 1 through the end of their tax year on June 30, 2026. The proposal still needs to pass Parliament, but it looks set to pass and Australia is likely to enact the first true tax on unrealized capital gains across the West. This tax will apply to all individuals with over $3 Million AUD in assets ($2 Million USD). This includes stocks, bonds, bitcoin, cash, properties, and almost anything else held in their “Super” retirement account.

It’s important to note that if an individual experiences losses in their assets or their account falls below the $3 Million AUD threshold, no refund is available for Division 296 tax paid in a prior year. This means that people may actually have to sell their retirement savings to pay for taxes on gains they did not even get to realize…

This is the stupidity and insanity of taxing unrealized capital gains.

Division 296 is not a tax on income, it is a tax on individual wealth. The Australian government told their citizens to invest in their Supers for retirement. They created it for long-term investing and gave tax advantages to get people in, and are now changing the rules mid-game while their assets are locked up. They sell this treasonous idea to average workers by applying it to only the “super rich” at first. However, this $3 Million AUD threshold is not expected to be indexed. This means that over time due to investment growth and inflation, more and more individuals will fall under this tax. It is purposefully written this way to slowly engulf more and more people. In fact, there are already rumors that Australia’s Treasurer has been working on ways to legally expand this tax once fully implemented, before inflation even gets the opportunity to accomplish the same.

As history shows, new taxes are always sold as “for the rich” today, but tomorrow it’s anyone who happened to save diligently for retirement or saw their home value rise. It’s worth remembering that Income Tax in the US only applied to the Top 1% of Americans when it was originally introduced:

Conclusion:

As Western governments scramble for more revenue to support their failed programs and millions of illegal immigrants, there is a growing wing of politicians that believe they have a right to your wealth before you do. Taxing unrealized capital gains is an economic disaster and a legitimate threat to capitalism. It’s not just mathematically insane… it’s outright authoritarian. This theory of taxation goes against the foundational concepts that our society was built on: limited government, individual liberty, property rights and free market capitalism. Still, if you think it won’t be tried in the US in the coming years, think again…

Kamala Harris already (briefly) supported a 25% tax on unrealized gains on the national stage. Her proposal of course only applied to the “mega-rich” as a selling point, but make no mistake, this dangerous ideology is growing and it will certainly be attempted again.

No wonder why millionaires and high-net-worth individuals are flocking to the UAE.

Given the growing lunatic-left here in the US, it's quite conceivable to see a push for this.

How are they supposed to pay the tax without selling the asset?