Can Powell Deliver A Santa Rally

The last Fed meeting of 2025 was an exciting one. I wanted to do a quick overview of what yesterday’s ‘Not-QE QE’ announcement meant, where things currently stand and look at how markets have historically performed in the last few weeks of the year. Let’s dive in…

FED MEETING:

Heading into yesterday’s Fed meeting, the overwhelming consensus was for a “hawkish cut”. Every analyst and expert expected a 25bp rate cut, but to have it watered down with a hawkish Fed statement and jawboning from Powell to temper future expectations. Instead, it ended up being more dovish than everyone expected.

Well… almost everyone.

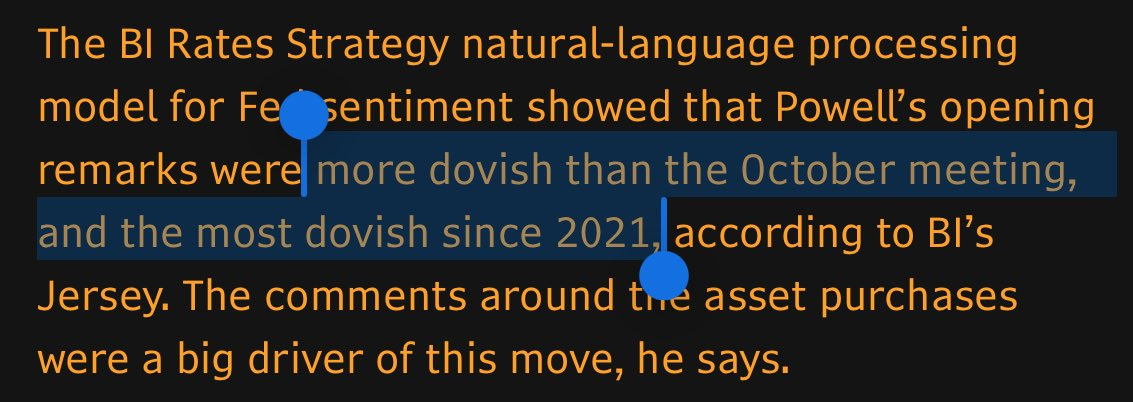

According to Bloomberg’s language and sentiment model, this was actually the most dovish Fed meeting in almost 5 years.

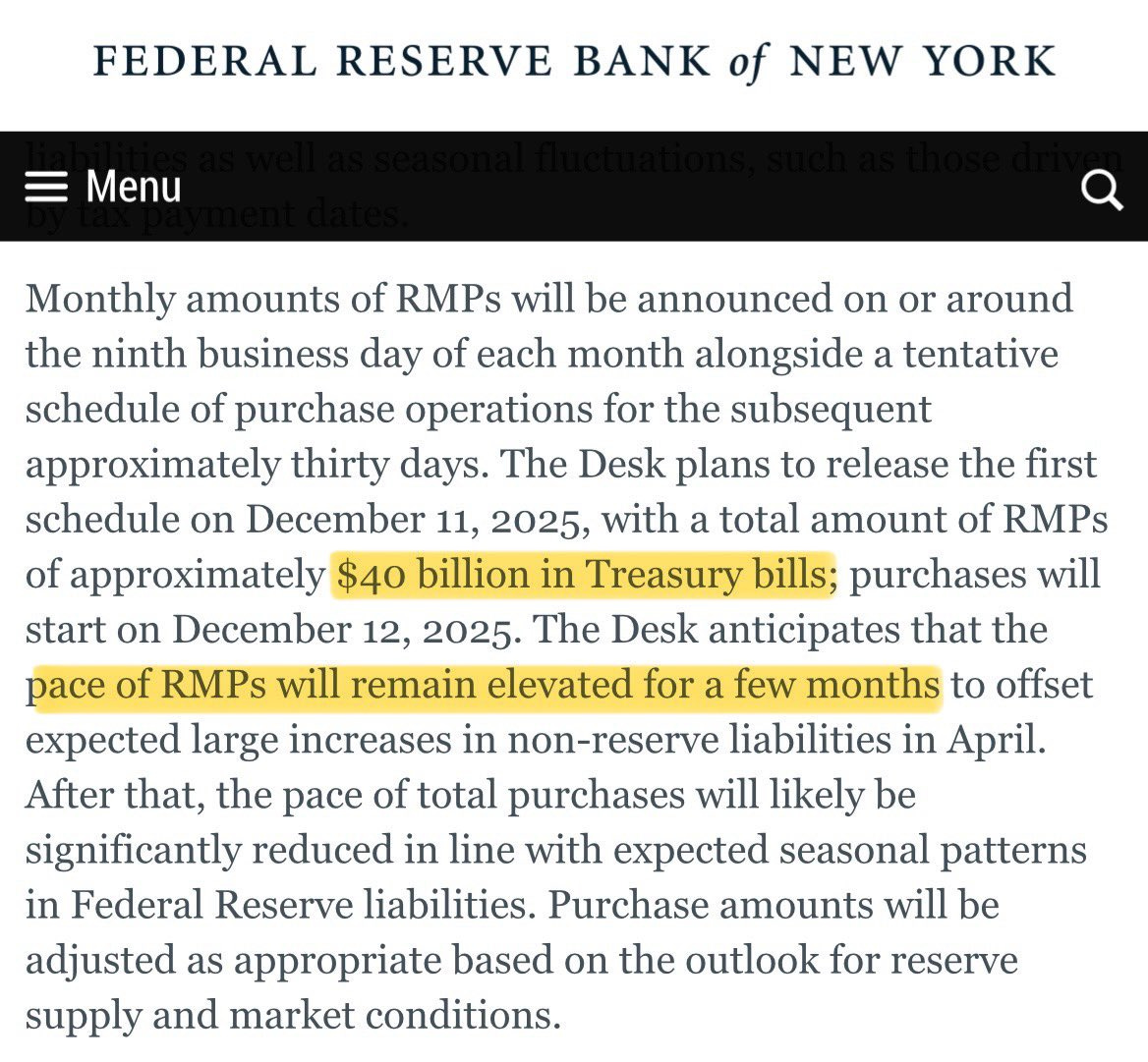

While the 25bp rate cut was dovish on it’s own, what really took the spotlight was the announcement that the Fed would begin buying Treasury bills, and buying a lot of them. They announced that they will be purchasing $40 Billion worth of T-bills every month for the next several months… and they are starting on Friday. Some smart people did think this action could be coming soon, but no one expected them to start right now, and certainly not in this amount.

So, what exactly does this mean?

It’s very simple.

The Fed drained reserves via QT too much, or at least too much for them to be comfortable sleeping at night. So to act without causing a massive panic, they are now buying Treasury bills (short-end) to avoid doing outright QE. Whether someone wants to call this QE or QE-lite or ‘Not-QE’ QE… it doesn’t mater. The bottom line is that the Federal Reserve is once again expanding their balance sheet and injecting liquidity. They are now printing reserves to finance the government’s deficits via bill purchases.

TLDR: They’re printing money.

WHERE MARKETS STAND + SANTA RALLY:

S&P 500 is just below 6,900 and up +17% YTD:

NASDAQ is just below 24,000 and up +23% YTD:

GOLD is just above $4,200 and up +60% YTD:

BITCOIN is hovering around $90,000 and down -5% YTD:

Overall it’s been another great year for the indices, even after the -19% drawdown and tariff tantrum in April. Being fully invested and buying the dip was rewarded, bigly. Big tech and the popular AI names have crushed it, while hard assets like Gold and commodities had incredible performance as the debasement trade. Of course, our wonderful Emerging Markets (LatAm) had a monster year, with Brazil EWZ 0.00%↑ up +45% YTD, blowing the S&P 500 out of the water.

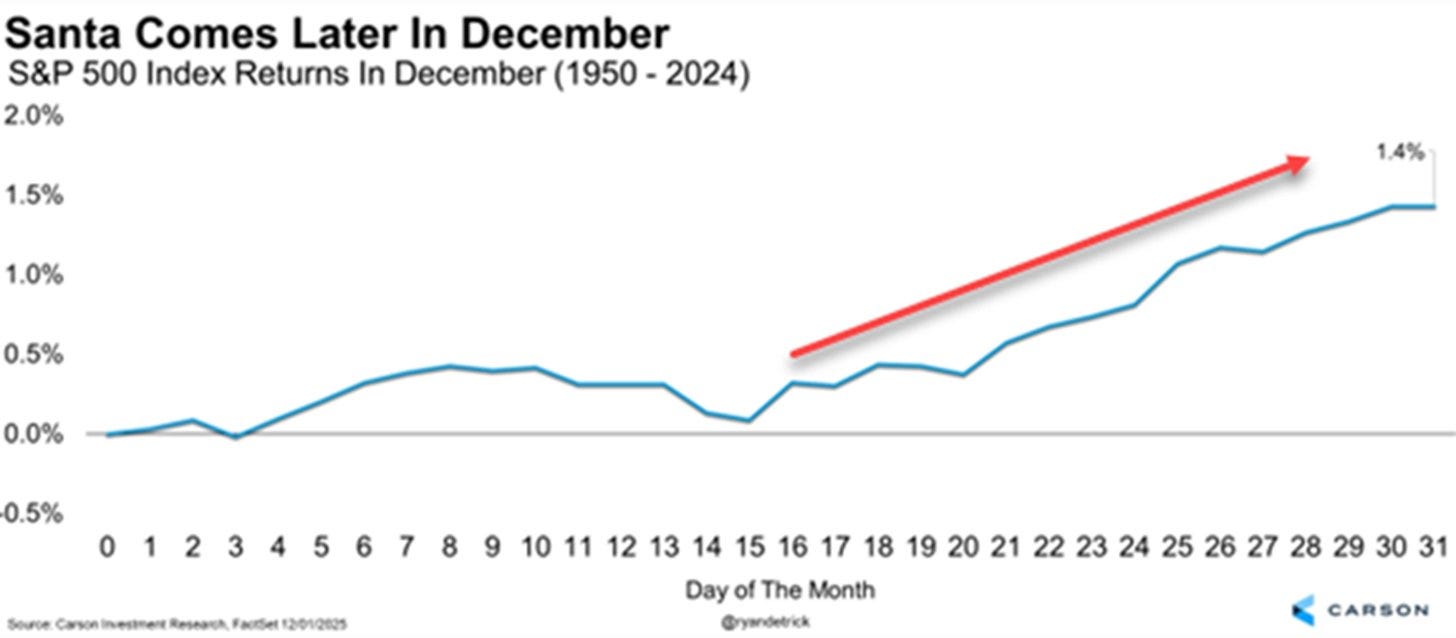

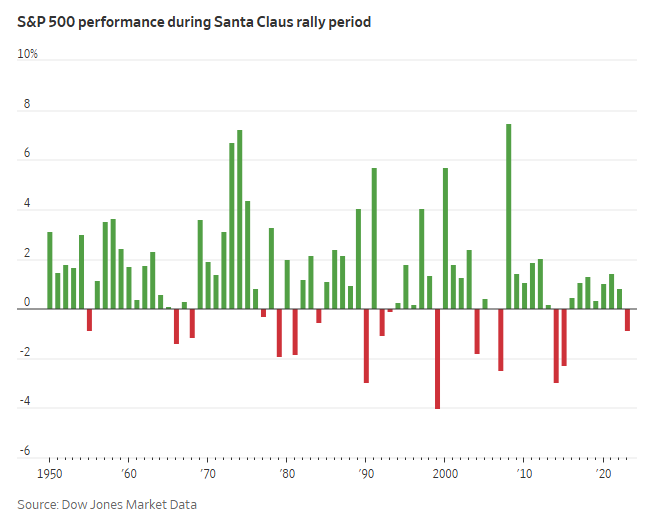

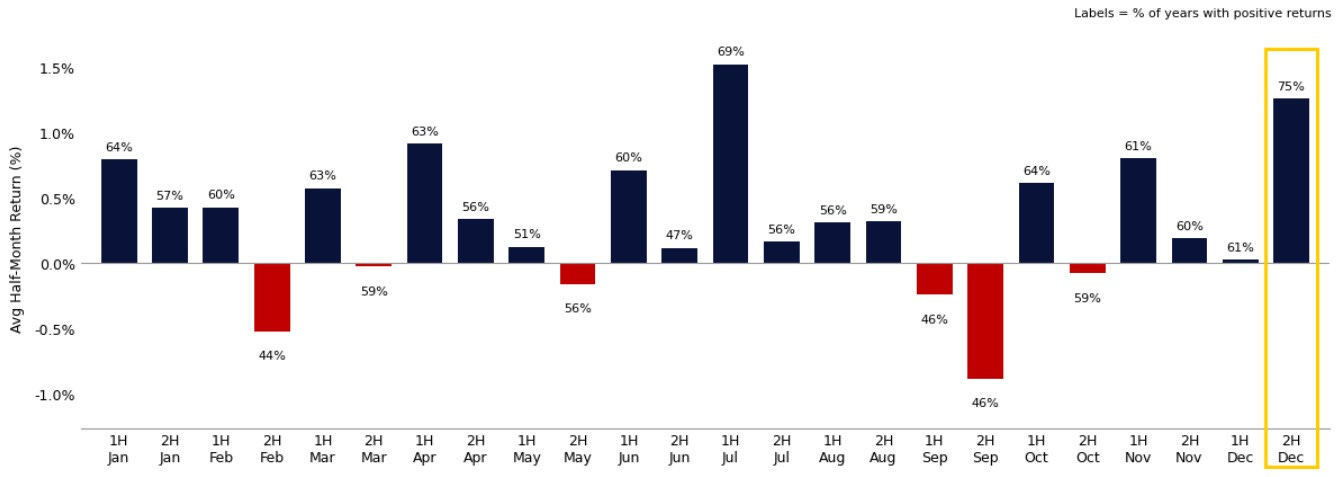

Now, with only a couple of weeks left in 2025 and Powell showing the Fed’s dovish hand, he may have cleared us for a Santa Rally. Over the last century, the back-half of December is actually one of the best periods of the entire year.

SPX December returns from 1950-2024:

Citadel’s equity guru Scott Rubner also expanded on this in his most recent note: “The second half of December has one of the best hit rates of any 2-week period of the year. SPX has traded higher 75% of the time, with an average return of +1.3% (average positive return = +2.1%)”

It’s important to note that seasonality and historic performance is not automatic. Markets can obviously move in unpredictable ways and we don’t know what the future holds. However, in my experience certain periods of the year tend to be more reliable than others when it comes to trends. The back half of December is indeed one of those periods due to the extremely low volume around the holidays.

SUMMARY:

The Fed has cut another 25bp and will now be expanding their balance sheet again via Not-QE QE. In addition to this undeniably dovish scenario, we have very strong seasonality in the back half of December providing us some tailwinds. To keep it short, after another massive year in markets I believe Powell may have set us up for a Santa Rally, and I’m looking for a strong close into year-end.

PS - I will have a new post in the next few days on a stock position that will be one of my largest headed into 2026. I will also have my full 2026 Market Outlook post up around Christmas, which will include a macro outlook as well as individual names and predictions. Both posts will be for subscribers only, so subscribe below.

As always, this is not financial advice. I am sharing my personal views. It is meant to stimulate ideas and is not to be considered investment advice. Please make your own decisions.

My polymarket short story. Can do collab post https://nimnim1.substack.com/p/poly-hell