Are Rich People Paying Taxes?

One of the great political moves by the left in recent years has been convincing a large portion of America that the rich don’t pay taxes and it’s all poor, working class people. You often hear this populist propaganda directly from politicians or on left-leaning news networks. In reality, the exact opposite is true. Let’s dive in…

Politicians on the left often depict wealthy Americans (excluding themselves of course) as tax-dodging freeloaders who refuse to contribute to the well-being of society. They argue that many of our nation’s problems and societal issues could be resolved if only “the rich” were less selfish and paid their fair share. On social media you regularly see viral posts like this one:

What many people don’t seem to understand, and don’t bother looking up, is that wealthy Americans already pay for a disproportionate share of tax revenue. If New York City elects a literal socialist as Mayor and implements his proposed additional tax on millionaires because of this widespread fallacy, the city could face an immediate crisis. That’s because the wealthy residents who make up the city’s actual tax base might flee for more friendly jurisdictions.

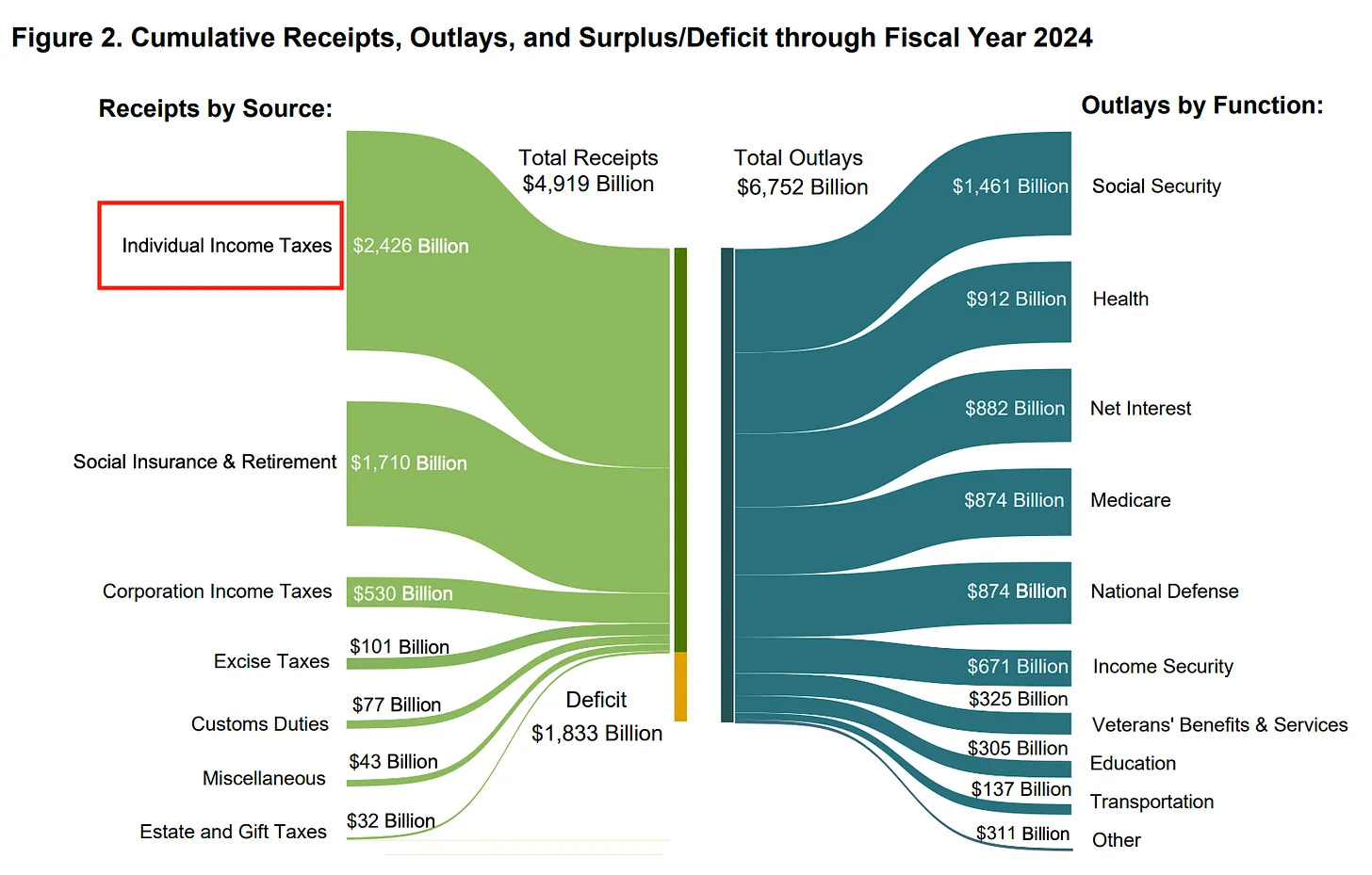

Let’s clear something up. While people love to focus of many different taxes, Individual Income Taxes are BY FAR the largest source of government revenue. In Fiscal Year 2024, Individual Income Taxes accounted for ~50% of all federal government receipts. Half of everything brought in. If you then dissect this most important and largest source of revenue, it becomes very clear that Americans at the top are paying for it disproportionately.

Looking at the chart above, which focuses on the share of income earned for 2024 and the share of income taxes paid, you quickly begin see the reality taking place. Earners who make less than $100,000 (including those who do not pay federal income taxes at all) bring in 26% of all income, but actually contribute *negatively* after tax credits are applied. Meanwhile, Americans who make over $500,000 per year bring in 23% of all income earned, yet pay 54% of all income taxes collected.

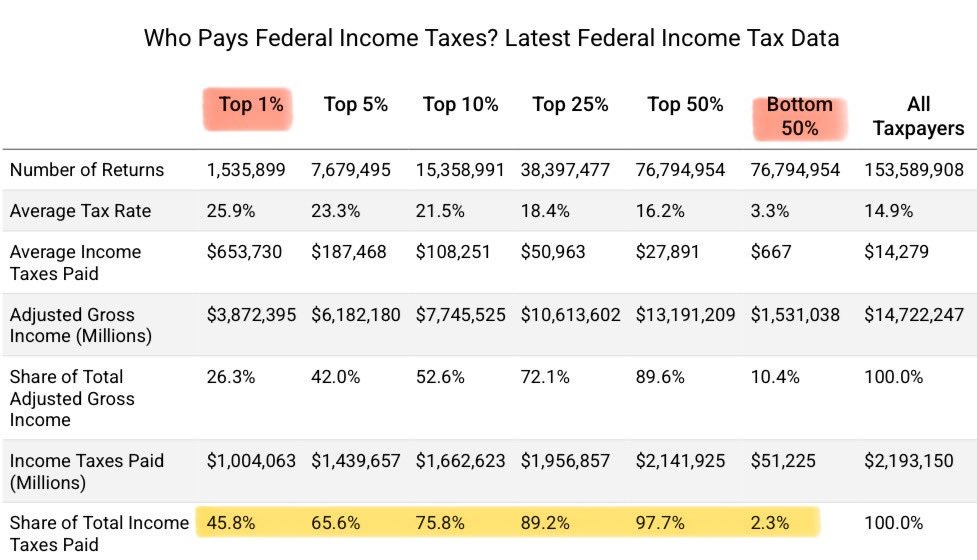

This can be broken down further by income percentile. As you can see below, the Top 1% of American earners paid exactly 46% of all income taxes collected in 2023.

Top 1% of earners pay 46%

Top 5% of earners pay 66%

Top 10% of earners pay 76%

Bottom 50% (*HALF*) of earners pay… 2%

Think about those splits. 1% of earners pay 46% of all federal income taxes. The bottom 50% pay just 2%. Half of America is contributing essentially nothing to our largest revenue pot. It’s mostly taken from the wealthy, with a sizable chunk also coming from what most would consider the “upper-middle class”. If we include those individuals (income of $190,000+), the Top 10% of earners are responsible for almost 80% of all federal income taxes.

A common response to these hard facts is that Billionaires and CEO’s don’t earn normal income. They expand their wealth using stocks, capital gains, and loans to avoid paying income taxes altogether. While there are some fair arguments to be made around this topic, the vast majority of “the rich” and even “the 1%” are not billionaires. In fact, most aren’t even multi-millionaires. In 2024, you needed a household income of roughly ~$750,000 to be considered in the Top 1% of American earners. The overwhelming majority of these people are indeed paying their income taxes, and happen to be paying a very large and disproportionate share compared to their poorer fellow Americans.

Even if we do look at the very top of the income ladder, the data says the same thing. In 2020 only 0.02% of filers (1 out of 5,000 people) had an income of $10 million or more. Those 0.02% of taxpayers paid for 13% of America’s total income tax collections.

To conclude, I’m not defending if the current tax system is good or bad. I just want to put this broad misconception to rest and make sure that Americans understand what is really happening. The hard truth is that rich and well-off Americans are paying taxes… a massive percentage of them. Another hard truth is that the bottom 50% of American earners, and specifically the bottom ~30%, are largely getting a free ride.

Here are the average effective income tax rates by income over 20 years:

BONUS! A quick look at New York:

Just as with the federal government, Individual Income Tax is the largest source of revenue for New York. Not surprisingly, “the rich” in New York also pay for a massively disproportionate share. In 2023, roughly 86,000 New Yorkers reported an annual income of at least $1 Million. This small group of millionaires made up just 0.8% of total tax filers, yet they accounted for 41% of total income taxes collected. Even more shocking, the Top 50% of New Yorkers paid 99.8% of the state’s income taxes.

Yes… 99.8%.

The bottom 50% (HALF) contributed nothing.

As always, this is not financial advice. I am sharing my personal views. It is meant to stimulate ideas and is not to be considered investment advice. Please make your own decisions.

Great explanation and graphics to help illuminate the facts of this topic. Fortunately, it reaffirms the complete ‘psy-op’ ongoing // underway by the mainstream media.

NYC is going to collapse when Bloomberg and others leave, it's just a fact. Hopefully mamdani will be the face of that collapse for generations